Secure banking with a blink of an eye

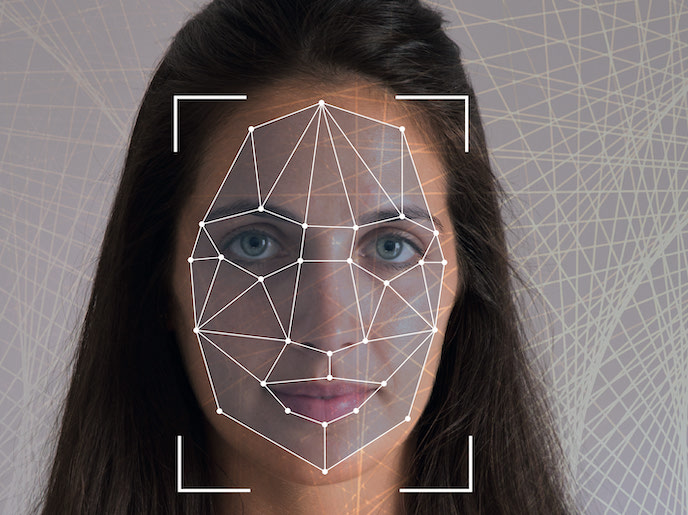

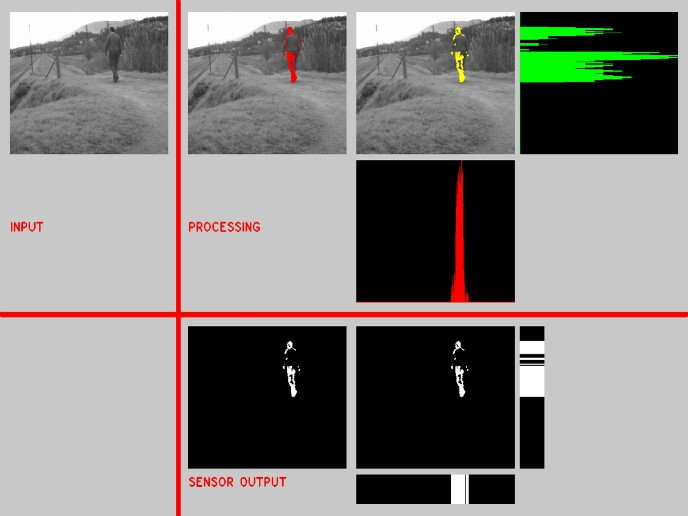

Security is a major concern for the banking industry with fraudulent transactions increasing every year and estimated at EUR 1.4 billion in Europe alone. Biometrics, in particular facial analysis, has become an important alternative to an easily-crackable PIN-code. But there is still some public nervousness about photographs of their faces being stored in vast databanks. The EU’s FACCESS project has helped develop a different type of face-recognition technology for use in banking. “We do not store an image. Our technology extracts the main points of the face, converts it into a numerical pattern which is like a very long number and this number is encrypted,” says Ms Tania Martínez, deputy manager of Spanish technology company FacePhi Biometría, a market leader in face-recognition technology and the company behind the project. When a customer first registers their identity with the bank, the encrypted facial code is stored in the bank’s server. The customer logs in, for example, by taking a selfie on their mobile phone. “The face’s pattern is compared to the one already in the bank’s secure server and if the two patterns are almost equal the technology says it is you and gives you access.” If the patterns are not quite close enough, it may ask for alternative or supplementary authentication, Martínez says. According to FacePhi data, the system’s false acceptance rate is 0.002 % and false rejections are between 2 % and zero. “This is because it is a smart technology which retrains every time you do the authentication,” Martínez explains. “So, if you arrive with makeup, or you are sad, or have lost weight, the technology learns these changes and creates a template of patterns which incorporates the differences.” The liveness detector The EU’s support helped develop additional security features such as a ‘liveness detector’ to avoid impersonation fraud, for example, if someone steals the customer’s mobile phone. It can detect if the person in front of the camera is a real person, not a picture or video.The liveness detector asks the customer to be very still and then blink. “The technology will detect the micro-movements,” explains Martínez. Another method is for the liveness detector to ask the customer to repeat a specific movement such as moving the face up, down, left or right. The algorithms created from scratch by the company are currently geared to the financial sector. It does not need the highest quality images or huge servers such as at airports which need to compare a face to their entire database of images. “The user is already saying who they are,” Martínez notes. It just requires 480 x 640 pixels – the minimum resolution for a camera – on any kind of device. Banks do not need any additional investment in hardware. Use in the financial sector FacePhi is currently working with 30 financial entities worldwide and has performed 500 million authentications in 2018, according to the company. The system can run on all operating systems, on multiple devices and can be easily integrated with bank services and existing banking apps. The system is sold as a software licence, adapted to the bank’s requirements, priced per user per year per platform. In collaboration with an ATM provider, CaixaBank, Spain’s largest retail bank has become the first bank worldwide to use face-recognition technology in ATMs with the FACCESS system, doing away with the need for cards and passwords. FacePhi is now combining facial, optical, fingerprint, contactless and voice recognition to provide what the company calls a ‘zero risk’ security system for banks.